Wednesday, November 30, 2005

Monday, November 28, 2005

Stocks Selloff

Stock Market Recap for 11/28/05

Dow 10,890.72 (-40.90)

Nasdaq 2,239.37 (-23.64)

S&P 1,257.46 (-10.79)

Stocks sold off today. My account was down over 2%, which is quite hard to swallow. If I see some more strength in the market I will be doing some selling. I will post the stocks that get sold once the trade goes through.

Dow 10,890.72 (-40.90)

Nasdaq 2,239.37 (-23.64)

S&P 1,257.46 (-10.79)

Stocks sold off today. My account was down over 2%, which is quite hard to swallow. If I see some more strength in the market I will be doing some selling. I will post the stocks that get sold once the trade goes through.

Thursday, November 24, 2005

Shortened Trading Session

I hope everybody had a happy Thanksgiving. Remember that the stock market closes at noon on Friday. The NYMEX, Chicago Board of Trade, and the Merc are all closed. I suspect very light volume. I don't plan on making any trades. I would like to ask if anybody recommends any trading software or software for trading option contracts.

Tuesday, November 22, 2005

Stock Pick: Intuitive Surgical (ISRG)

First off, I would like to say that this stock at its 52 week high. ISRG is up a lot but I still think it goes higher. I listened to the latest conference call and I believe ISRG will sell at least 30 of the da Vinci Surgical Systems in Q4. Wall Street estimates of $0.49 are too low for Q4. I believe ISRG will earn between $0.50-$0.60 in Q4. The bear case for ISRG is that they will be taxed between 30-40% in 2006 and that will hurt future earnings. ISRG is still enjoying a 7% tax rate because of previous losses. Also ISRG has met sales goals in 2005 so further sales in 2005 will credit more bonuses to employees and lower earnings per system sold I still think there is a lot of room to grow in ISRG's patented technology.

If you are serious about ISRG then I think you should visit their investor relations home page.

There is a PDF Investor Presentation that is worth reading (Need Adobe to View).

Note: I currently have no position in ISRG but I am considering buying near these levels.

If you are serious about ISRG then I think you should visit their investor relations home page.

There is a PDF Investor Presentation that is worth reading (Need Adobe to View).

Note: I currently have no position in ISRG but I am considering buying near these levels.

Monday, November 21, 2005

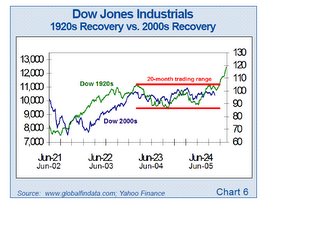

Bullish or Bullsh*t Stock Market Chart

You got to love what I call the "super bulls." These are people that are bullish on the stock market the vast majority of the time. I am not ripping on "super bulls" or "super bears." I think a healthy stock market needs both. I came across Harry S. Dent's website, which has a preview version of his newsletter. I pulled this chart from the newsletter.

Mr. Dent will be right eventually. The Dow cannot trade between 10,000 and 11,000 for the rest of eternity. It might help to put some good companies in the Dow. Or at least take out the "52 Week Low" stocks (Alcoa, GM, Merck, SBC/AT&T, Pfizer, Verizon, and maybe even Disney and then things don't look to bad).

Mr. Dent's thesis is that the Dow will breakout to the upside 300+% between now and 2010. I hope he is right.

Stock Pick: Banco Bradesco (BBD)

I had some cash to use today and bought Brazilian bank Banco Bradesco (NYSE: BBD). I wanted to increase my international stock exposure. The only other ADR that I own is America Movil (AMX). Banco Bradesco is benefiting from a growing Latin American economy and increased foreign investment. With a growing economy there is great demand for cars in Brazil and they need loans. Banco Bradesco will continue to benefit from loan growth. I was considering buying Unibanco (UBB) but I feel (BBD) has better momentum. I still believe both are good investments.

With this purchase my portfolio is 10% ADR/International stocks.

With this purchase my portfolio is 10% ADR/International stocks.

Sandisk (SNDK) Stock Selloff

Sandisk (NASDAQ: SNDK) is selling of today with news out that Intel (INTC) and Micron (MU) are teaming up to form a joint venture called IM Flash Technologies. IM Flash is expected to take a bite out of Sandisk's business. If you are a Sandisk shareholder you are down about 15-16% today. You have to give Jim Cramer props because I know he became bearish on Sandisk when it was around $60-$62. Now the stock is in the $46-47. I don't know enough about the flash memory business to tell you to buy or sell the stock but I have limited my technology exposure in 2005.

Sunday, November 20, 2005

Boeing's Booming Business

Boeing (NYSE: BA) had a rather productive weekend. China placed an order to buy (70) 737 airliners for $4 billion and looks to purchase (80) more. Emirates Airlines bought (42) 777 airliners for $10 billion. I admit I have been a non-believer in Boeing and have shied away from their stock. I figure if your customers are filing for bankruptcy then it's probably is not a good business to be in. Plus US manufacturing labor costs are becoming more unfavorable everyday (See GM, Ford, Visteon). Clearly I took a simplistic approach because countries that can be considered "emerging markets" are buying lots of commercial aircraft. US domestic carries that are in bankruptcy need more efficient planes and receive generous financing. All of this is good news for Boeing shareholders.

In October I purchased shares of Titanium Metals (NYSE: TIE). TIE was up 323% YTD when I made my purchase. I am now up 36% since then. So buying high does work once in a while. TIMET is one of Boeing's suppliers and continues to see record prices for titanium. Titanium is not used just for airplanes but many other products like golf clubs, computers, and medical equipment. Several factors made me buy TIE over BA. The first being a slew of insider purchases, a relatively small float/marketcap, no steel exposure/only titanium, increased pricing power, only one analyst covers TIE/upgrades/coverage coming, and the chart showed good relative strength.

Note: I have no position in Boeing (BA) but I am long (TIE)

In October I purchased shares of Titanium Metals (NYSE: TIE). TIE was up 323% YTD when I made my purchase. I am now up 36% since then. So buying high does work once in a while. TIMET is one of Boeing's suppliers and continues to see record prices for titanium. Titanium is not used just for airplanes but many other products like golf clubs, computers, and medical equipment. Several factors made me buy TIE over BA. The first being a slew of insider purchases, a relatively small float/marketcap, no steel exposure/only titanium, increased pricing power, only one analyst covers TIE/upgrades/coverage coming, and the chart showed good relative strength.

Note: I have no position in Boeing (BA) but I am long (TIE)

Saturday, November 19, 2005

Motorola's Stock Ready to Rise

I have liked Motorola (NYSE: MOT) since late July of 2005. I can't say I called the bottom but I have enjoyed the ride by purchasing calls and owning the individual stock. Motorola's holiday lineup seems to be pretty solid. Motorola will release a new RAZR phone called the RAZR V3i , which is an upgrade from the current RAZR phone. The RAZR V3i will have iTunes music, 1.23 megapixel camera, plus there will be a slot for swappable memory.

Motorola will also be releasing a phone called the SLVR L7 with iTunes.

It is also rumored that the old Motorola RAZR cell phone will be offered on Black Friday for only $88.73 at Wal-Mart. It currently retails for $199. This should give Motorola's stock and sales a nice boost.

Note: I am long Motorola (NYSE: MOT)

Friday, November 18, 2005

Upcoming IPO's to Watch

After my successful predictions of Sunpower (SPWR), Intercontinental Exchange (ICE), and Under Armor (UARM) I have been asked to look for more money making stocks to watch.

Here is my upcoming IPO watch list

Here is my upcoming IPO watch list

- Mastercard (NYSE: MA)

- NYSE/Archipelago (Must own shares of AX)

- Chipolte Mexican Grill (NYSE: CMG)

Stock Portfolio Performance

Year To Date Portfolio Performance = 10.3%

(Includes commissions, dividends, and option activity)

Year To Date Portfolio Performance = 6.7%

(Includes commissions & dividends but excludes option activity)

Buying calls has really been a positive for my overall return in 2005.

Indices YTD Performance 11/18/05

Russell 3000® Growth Index: 5.22%

S&P 500 Total Return: 4.69% (Includes Dividends but not reinvested)

Nasdaq Composite: 2.27%

Nsadaq 100: 3.8%

(Includes commissions, dividends, and option activity)

Year To Date Portfolio Performance = 6.7%

(Includes commissions & dividends but excludes option activity)

Buying calls has really been a positive for my overall return in 2005.

Indices YTD Performance 11/18/05

Russell 3000® Growth Index: 5.22%

S&P 500 Total Return: 4.69% (Includes Dividends but not reinvested)

Nasdaq Composite: 2.27%

Nsadaq 100: 3.8%

Thursday, November 17, 2005

Under Armor (UARM) IPO Prices at $13

I just checked with Charles Schwab and Under Armor (NASDAQ: UARM) priced at $13 a share. 12,006,000 shares were sold. We just have to wait and see were this stock opens tomorrow. I predict it will open at $17. I would not be surprised if it hits $20 or even $26 for that matter.

Sunpower IPO (SPWR)

Sunpower officially began trading today on the Nasdaq: ticker symbol (SPWR). The stock priced at the high end of the range and then ran up 41% today to close at $25.45. I had owned Cypress Semiconductor Jan 15 Call options for this play. I sold all of them a few days ago for $2.00 each. I think you have to let Sunpower (SPWR) come in a little bit if you wanted to buy some shares.

Once I hear where Under Armor's (UARM) stock prices at I will let you know. Congratulations to all that have seen nice gains in Sunpower (SPWR) and IntercontinentalExchange (ICE).

Once I hear where Under Armor's (UARM) stock prices at I will let you know. Congratulations to all that have seen nice gains in Sunpower (SPWR) and IntercontinentalExchange (ICE).

Wednesday, November 16, 2005

XBOX 360 Stock Plays

Here are some XBOX 360 stock plays. I have no position in any of them as of 11/16/05. I might consider buying some of them.

Activision (ATVI) - Has a few video games that are included in some of the XBOX 360 bundles.

ATI (ATYT) - makes video card inside XBOX 360.

Electronic Arts (ERTS) - Publisher of Madden Football Video game. Rather pricey stock.

Gamestop (GME) - I recommended this stock back at $30 in October. Retailer should see a good Q4.

Logitech (LOGI) - Makes special remote for XBOX 360. Logitech also makes a variety of highly rated products.

Take-Two (TTWO) - Controversial game publisher of Grand Theft Auto. Also has a division called Joytech that makes the controllers for XBOX 360.

Please do your own research before buying any of these stocks.

Activision (ATVI) - Has a few video games that are included in some of the XBOX 360 bundles.

ATI (ATYT) - makes video card inside XBOX 360.

Electronic Arts (ERTS) - Publisher of Madden Football Video game. Rather pricey stock.

Gamestop (GME) - I recommended this stock back at $30 in October. Retailer should see a good Q4.

Logitech (LOGI) - Makes special remote for XBOX 360. Logitech also makes a variety of highly rated products.

Take-Two (TTWO) - Controversial game publisher of Grand Theft Auto. Also has a division called Joytech that makes the controllers for XBOX 360.

Please do your own research before buying any of these stocks.

Tuesday, November 15, 2005

Intercontinental (NYSE: ICE) IPO Prices at High End

I just checked with Charles Schwab and the Intercontinental Exchange IPO (NYSE: ICE) priced at $26. This was at the high end of the range. Originally slated to price between $18-22 at 13.5 million shares. The size allotment increased to 16 million shares.

Cypress Semiconductor's Sunpower IPO also increased its range from $12-$14 to $16-$18.

Under Armor also increased their range from $7.50-$9.50 to $10-$12.

Cypress Semiconductor's Sunpower IPO also increased its range from $12-$14 to $16-$18.

Under Armor also increased their range from $7.50-$9.50 to $10-$12.

Monday, November 14, 2005

IPOs to Watch

Intercontinental (NYSE: ICE) has already doubled its expected IPO revenue. The IPO is so hot that they had to raise the offering price range to $24-$26 per share and increased the total number of shares available to 16 million from ten million. And remember, you heard it first from me yesterday.

I have not heard any other updates as far as the Under Armor (UARM) or Sunpower (SPWR) IPO. I know both of them will price this week. Sunpower looks to start trading on Friday November 18th. Also keep an eye on the Mastercard IPO. I suggest that you call your broker and try to get into these IPOs if possible. I still think they will all buy good buys if you buy them on the open market the first day of trading.

I have not heard any other updates as far as the Under Armor (UARM) or Sunpower (SPWR) IPO. I know both of them will price this week. Sunpower looks to start trading on Friday November 18th. Also keep an eye on the Mastercard IPO. I suggest that you call your broker and try to get into these IPOs if possible. I still think they will all buy good buys if you buy them on the open market the first day of trading.

Sunday, November 13, 2005

IntercontinentalExchange (NYSE: ICE) IPO Will be Hot

IntercontinentalExchange (NYSE: ICE) will price its IPO and begin trading sometime between 11/14/05-11/18/05. The timing is excellent for electronic trading and exchanges. Just look at the success of the Chicago Merc (CME), Chicago Board of Trade (BOT), The Nasdaq Company (NDAQ), International Securities Exchange (ISE), and Archipelago (AX).

IntercontinentalExchange makes most of its money by charging transaction fees, market data fees, and trading access fees. ICE is the leading electronic global futures and OTC market.

Net Profit Margin: 20.2% compared to Chicago Board of Trade's 11%

2004 Sales (mil.) $108.4

1-Year Sales Growth 15.6%

2004 Net Income (mil.) $21.9

1-Year Net Income Growth 64.1%

2004 Employees: 200

What is traded on the IntercontinentalExchange?

IntercontinentalExchange makes most of its money by charging transaction fees, market data fees, and trading access fees. ICE is the leading electronic global futures and OTC market.

Net Profit Margin: 20.2% compared to Chicago Board of Trade's 11%

2004 Sales (mil.) $108.4

1-Year Sales Growth 15.6%

2004 Net Income (mil.) $21.9

1-Year Net Income Growth 64.1%

2004 Employees: 200

What is traded on the IntercontinentalExchange?

- Oil & Refined Products

- Natural Gas

- Electricity

- Emissions

Saturday, November 12, 2005

Under Armor (UARM) IPO

I usually don't like recomending buying into an IPO but their have been many successful IPO's this year including Baidu (BIDU), Freight Car America (RAIL), Chicago Board of Trade (BOT), Irobot (IRBT), Hoku scientific (HOKU), Bronco Drilling (BRNC), and China Medical (CMED) just to name a few.

I think you should try to pick up some shares of Under Armor (UARM). Under Armor is expected to price on 11/17/2005. The stock will trade on the Nasdaq with a ticker symbol (UARM). Under Armor is profitable and they are the official athletic supplier to MLB and NHL. Their products are also sold in retail stores and are used by high school and college athletes in various sports.

Proposed Offer Price: $7.50 to $9.50

Shares Offered (mil.): 12.01

Offering Amount (mil.): $102.05

Post-Offering Shares (mil.): 46.37

1-Year Sales Growth: 77.8%

2004 Net Income (mil.): $16.3

1-Year Net Income Growth: 184.0%

2004 Employees: 546

I think you should try to pick up some shares of Under Armor (UARM). Under Armor is expected to price on 11/17/2005. The stock will trade on the Nasdaq with a ticker symbol (UARM). Under Armor is profitable and they are the official athletic supplier to MLB and NHL. Their products are also sold in retail stores and are used by high school and college athletes in various sports.

Proposed Offer Price: $7.50 to $9.50

Shares Offered (mil.): 12.01

Offering Amount (mil.): $102.05

Post-Offering Shares (mil.): 46.37

1-Year Sales Growth: 77.8%

2004 Net Income (mil.): $16.3

1-Year Net Income Growth: 184.0%

2004 Employees: 546

Friday, November 11, 2005

Portfolio Return

1 Year Portfolio Return: 8.7%

1 Year S&P 500 Return: 8.0%

Holdings as of 11/11/2005

Other (28.51%)

1 Year S&P 500 Return: 8.0%

Holdings as of 11/11/2005

Other (28.51%)

Thursday, November 10, 2005

Closed Cypress Call Options

I sold all of my Cypress Semiconductor (NYSE: CY) call options today for $2 each. The position returned a nice 58% gain in less than three months. I am looking to put that money into a financial or LTM, BBD, UBB, GME, BBY, ATVI, or a casino stock like HET.

Wednesday, November 09, 2005

Savings Accounts

ING Direct just raised their savings rate to 3.50%. Currently, Emigrant Direct has the highest savings account yield at 4% with no minimum to open an account. The Paypal money market account is yielding 3.93% minus the .11% expense ratio.

Highest Yielding Savings or Money Market Accounts

Emigrant Direct 4% (Savings Account)

Paypal Money Market 3.93% (Must open a Paypal account: free)

Capital One 3.75% (Money Market Account)

Nexity Bank 3.75% (Money Market Account)

ING Direct Savings 3.50% (Savings Account)

Money market accounts are not FDIC insured and have expense ratios.

Highest Yielding Savings or Money Market Accounts

Emigrant Direct 4% (Savings Account)

Paypal Money Market 3.93% (Must open a Paypal account: free)

Capital One 3.75% (Money Market Account)

Nexity Bank 3.75% (Money Market Account)

ING Direct Savings 3.50% (Savings Account)

Money market accounts are not FDIC insured and have expense ratios.

Tuesday, November 08, 2005

Toll's Stock Taking a Toll

Homebuilder Toll Brothers (NYSE: TOL) said they are cutting 2006 earnings guidance and expect to sell fewer homes in 2006 than in 2005. Toll Brothers stock was down 14% today or $5.50. The shorts were all over this one (16.58 million shares short or 12.5% of the float). Toll Brothers CEO Bob Toll said that "Since Katrina, instead of going up $5,000 or $10,000 every week or two, we have been limited to no price increases or very limited price increases."

So is this the top in housing? I really couldn't tell you, I think real estate peaked in June and is headed for some rough times of 2-5% annual appreciation. I would be moving the cash from real estate into the stock market.

Note: I am long homebuilder Lennar (NYSE: LEN) but have no position in Toll Brothers (TOL)

So is this the top in housing? I really couldn't tell you, I think real estate peaked in June and is headed for some rough times of 2-5% annual appreciation. I would be moving the cash from real estate into the stock market.

Note: I am long homebuilder Lennar (NYSE: LEN) but have no position in Toll Brothers (TOL)

Monday, November 07, 2005

Investing in a Japan Index ETF

I like the Ishares MSCI Japan Index (EWJ). It is right at its 52 week high. The ETF 's largest holding is Toyota Motor.

Another ETF that I like is the Ishares Emerging Markets Index (EEM). The Emerging Markets ETF is almost four points off its 52 week high.

Both ETF's have low expense ratios making them more attractive than most mutual funds. I believe that you should have at least 10% of your portfolio in international stocks.

Another ETF that I like is the Ishares Emerging Markets Index (EEM). The Emerging Markets ETF is almost four points off its 52 week high.

Both ETF's have low expense ratios making them more attractive than most mutual funds. I believe that you should have at least 10% of your portfolio in international stocks.

Saturday, November 05, 2005

New Stock Pick: Life Time Fitness (LTM)

I am going to initiate a "buy" on Life Time Fitness (NYSE: LTM). If you can pick some shares up under $37 or $36.50 that would be a gift. I have actually been inside these centers and they much nicer than any fitness center I have ever been in. You can take a virtual tour on Life Time's Website. They are the country club for the suburban middle class and upper middle class ($50,000-$200,000). Life Time Fitness is more family oriented than Bally Total Fitness (BFT) and can appeal to a broader market. Look for earnings growth of 20-30% for the next five years. Hopefully I can add LTM to my portfolio before the end of 2005.

Other Interesting Notes:

Other Interesting Notes:

- 7.80% of Float is Short

- Fidelity Contra Fund is the largest mutual fund owner: 2%

- Institutional Ownership: 58.6% (MSN Money)

- 35 Million Shares Outstanding

- Lots of Institutional Buying

- Buyers: 8,300,815

- Sellers: -1,922,088

Thursday, November 03, 2005

What's in Bernanke's Portfolio?

What is the other "Big Ben" holding in his account? According to disclosure reports, new Federal Reserve Chairman Ben Bernanke is weighted 50% stocks and 50% fixed income. That is a rather conservative approach. I am 88% stocks and 12% (money market/savings) but I am 33 years younger than Mr. Bernanke.

Ben Bernanke's Portfolio

Stocks

Altria (MO) (I also own Altria) ($15,001-$50,000)

Mutual Funds

Merrill Lynch US High Yield Fund (MRCHX) ($15,001-$50,000)

Merrill Lynch Large Cap Core (MDLRX) ($1,001-$15,000)

Merrill Lynch Fundamental Growth (MDFGX)($1,001-$15,000)

Vanguard International Growth Fund (VWIGX)($1,001-$15,000)

TIAA-CREF 403 (b) Joint account w/wife ($1 million-5 million)

Canadaian Treasury Bonds ($50,000-$100,000)

US Treasury Strips ($1,001-$15,000)

Source: Investors Business Daily

Ben Bernanke's Portfolio

Stocks

Altria (MO) (I also own Altria) ($15,001-$50,000)

Mutual Funds

Merrill Lynch US High Yield Fund (MRCHX) ($15,001-$50,000)

Merrill Lynch Large Cap Core (MDLRX) ($1,001-$15,000)

Merrill Lynch Fundamental Growth (MDFGX)($1,001-$15,000)

Vanguard International Growth Fund (VWIGX)($1,001-$15,000)

TIAA-CREF 403 (b) Joint account w/wife ($1 million-5 million)

- It is presumed that the TIAA-CREF account is invested in index funds

Canadaian Treasury Bonds ($50,000-$100,000)

US Treasury Strips ($1,001-$15,000)

Source: Investors Business Daily

Cypress Call Options

As you have read, I purchased Cypress Semiconductor (CY) January 15 call options on 9/26/05 for $1.50 and again on 10/19/05 for $0.65. I was able to lower my cost basis in this position and see it trade above my original purchase price. Cypress plans on spinning off it's Sunpower (solar division) this quarter. You can view the prospectus for Sunpower. I have a nice gain in this position and have watched the stock go up 25% this week. I feel it would be greedy not to take profits at this level. I will sell 50% of my call options tomorrow.

Tesoro Petroleum Beats Wall Street Estimates

Tesoro Petroleum (NYSE: TSO) beat Wall Street estimates by $0.03. Earnings came in at $3.20 compared to $0.93 a share a year ago. Tesoro also announced it will buy back $200 million dollars worth of stock and double the quarterly dividend to $0.10. Tesoro is in the business of refining petroleum. Their success in Q3 was due to favorable crack spreads, increased demand, and increased daily production. Tesoro is flooded with money and they are creating value for shareholders, which is not a bad thing at all.

Note: I am long Tesoro (TSO)

Note: I am long Tesoro (TSO)

Wednesday, November 02, 2005

Stocks Reporting Earnings

Two stocks that I own report earnings tomorrow.

Tesoro Petroleum (NYSE: TSO) Yahoo Finance has a mean estimate of $3.17

Titanium Metals Corporation (NYSE: TIE) Estimate of $0.64

Let's see how the market reacts.

Tesoro Petroleum (NYSE: TSO) Yahoo Finance has a mean estimate of $3.17

Titanium Metals Corporation (NYSE: TIE) Estimate of $0.64

Let's see how the market reacts.

Tuesday, November 01, 2005

Emerging Market Stock Exposure

I already own America Movil (NYSE: AMX) for my portfolio. I am looking to add either Banco Bradesco (NYSE: BBD) , Unibanco (NYSE: UBB), or Banco Sander (NYSE: SAN). Latin America is hot and the emerging market stocks have more upside than US stocks at least in the short term. I also own ICICI Bank (NYSE: IBN).

Recent Stock Pick Performance

Recent Stock Picks That I Own

10/12/05 Motorola @ $19.74 Up 11.0%

10/14/05 Titanium Metals (TIE) @ $40.65 Up 20.0%

10/17/05 Gilead Sciences (GILD) @ $47.69 Down 0.5%

10/24/05 Chesapeake Energy (CHK) @ $30.27 Up 3%

Stock Pick Suggestions That I Don't Own

10/10/05 Gamestop (GME) Up 12%

10/30/05 Diamonds Exchange Traded Fund (DIA) Up 1%

Not a bad stock picking performance considering how rough the stock market has been of late.

10/12/05 Motorola @ $19.74 Up 11.0%

10/14/05 Titanium Metals (TIE) @ $40.65 Up 20.0%

10/17/05 Gilead Sciences (GILD) @ $47.69 Down 0.5%

10/24/05 Chesapeake Energy (CHK) @ $30.27 Up 3%

Stock Pick Suggestions That I Don't Own

10/10/05 Gamestop (GME) Up 12%

10/30/05 Diamonds Exchange Traded Fund (DIA) Up 1%

Not a bad stock picking performance considering how rough the stock market has been of late.